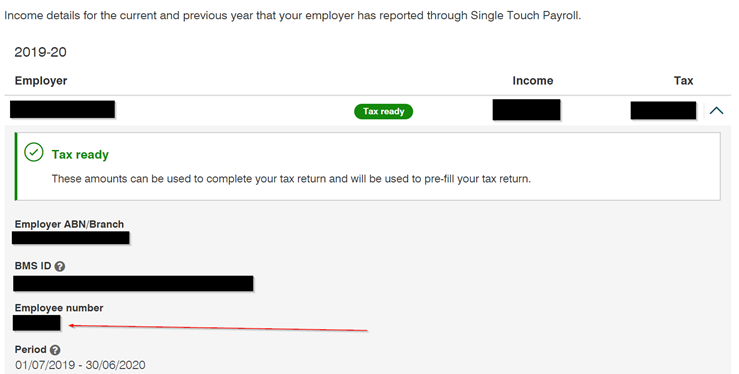

Two Income Statements in MyGov account (one 'Tax ready' and one 'Not Tax Ready') - Reckon Help and Support Centre

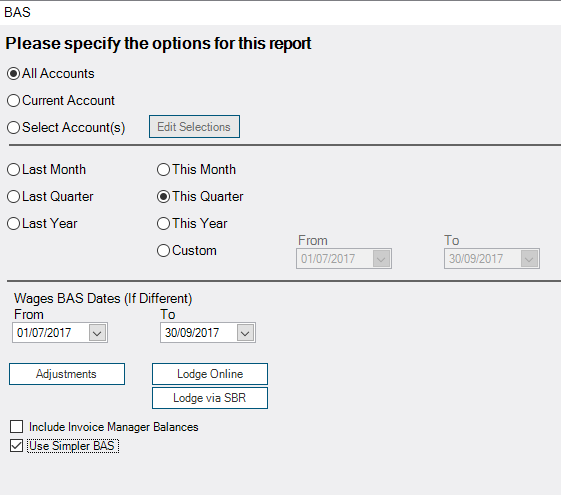

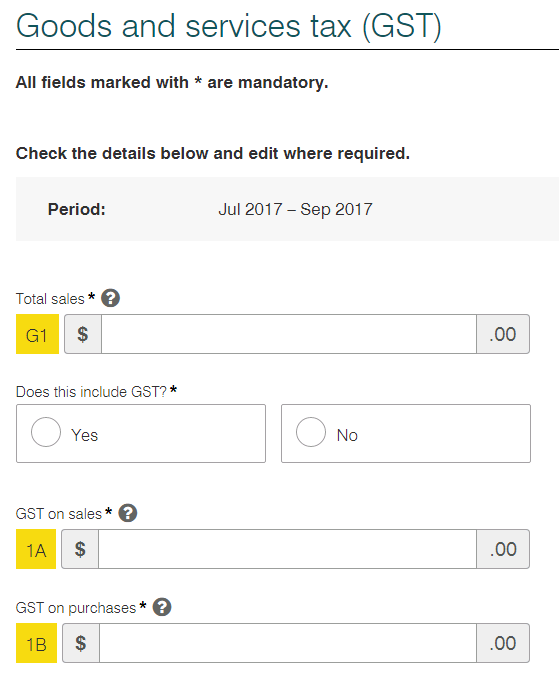

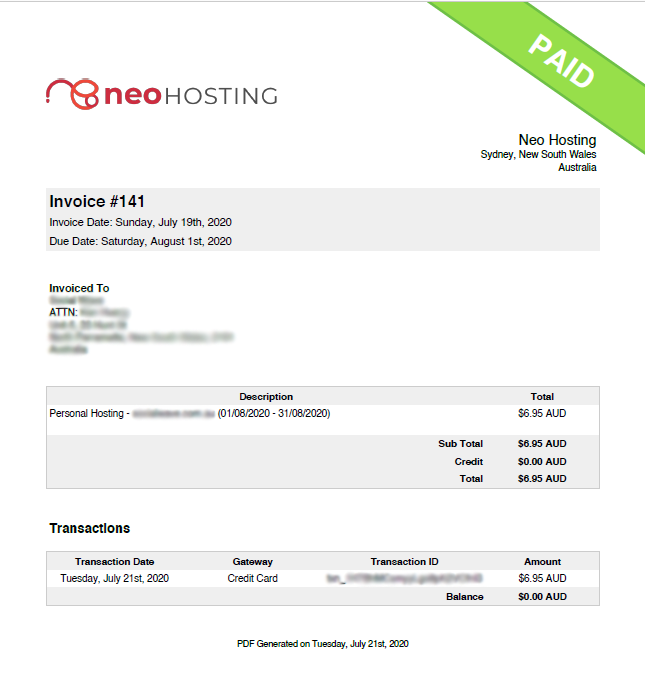

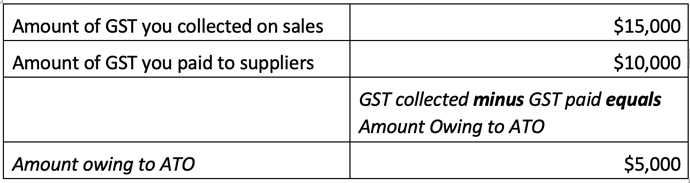

Acceptable BAS evidence: 1. A copy of your most recently lodged BAS for the 2019-20 financial year from the ATO's Business Por

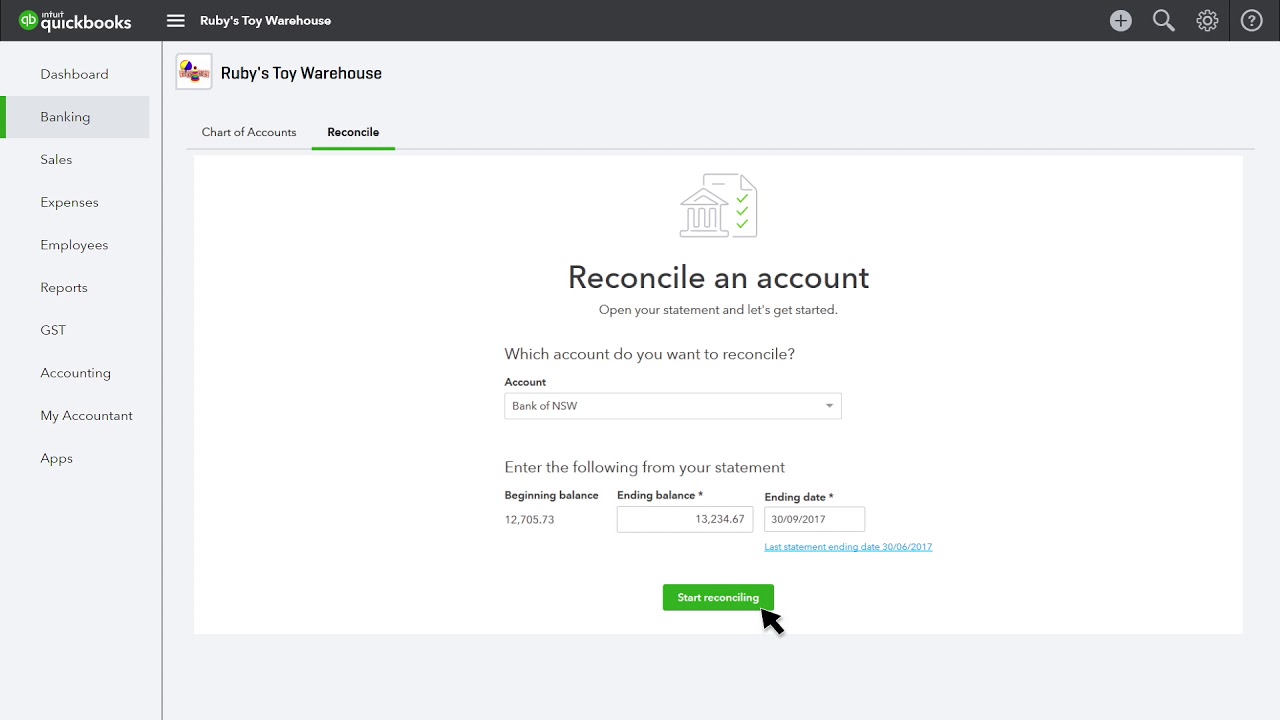

Australian Taxation Office - BAS tip: Check twice to make sure you only have to lodge once! Avoid common BAS errors by checking all invoices are correct, claiming for the current tax

Australian Taxation Office - Do you lodge your BAS online via myGov? We'll send you email or SMS notifications to let you know when there are new messages in your myGov Inbox.