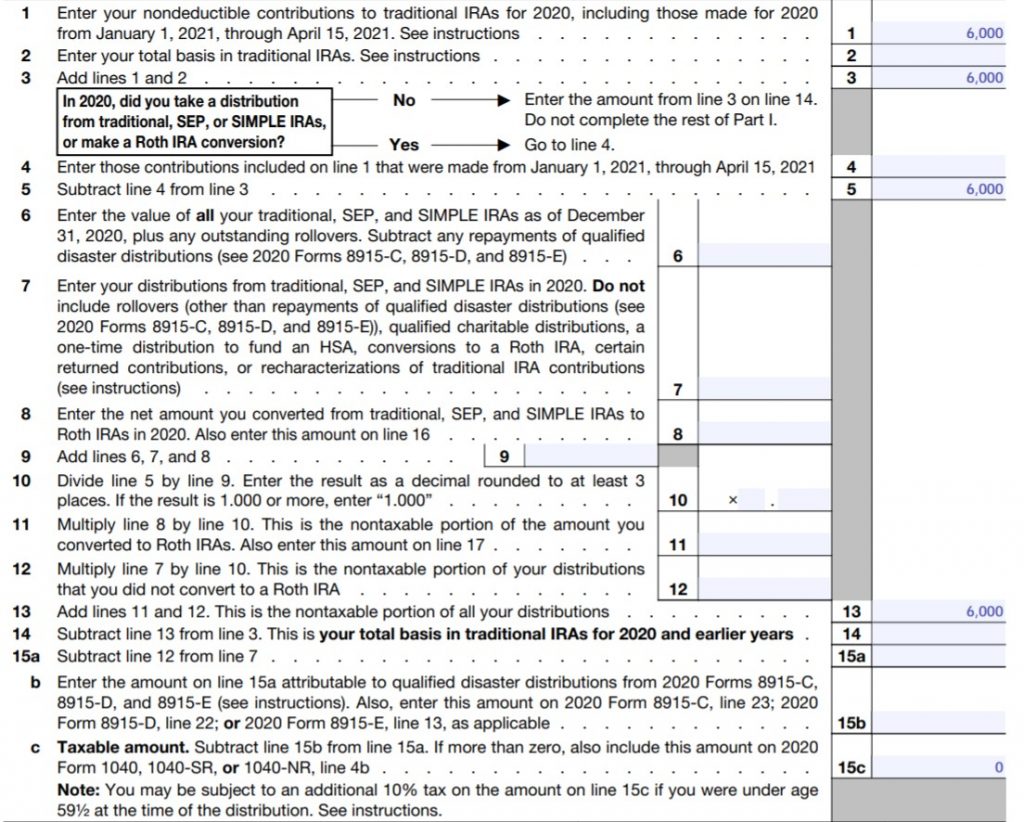

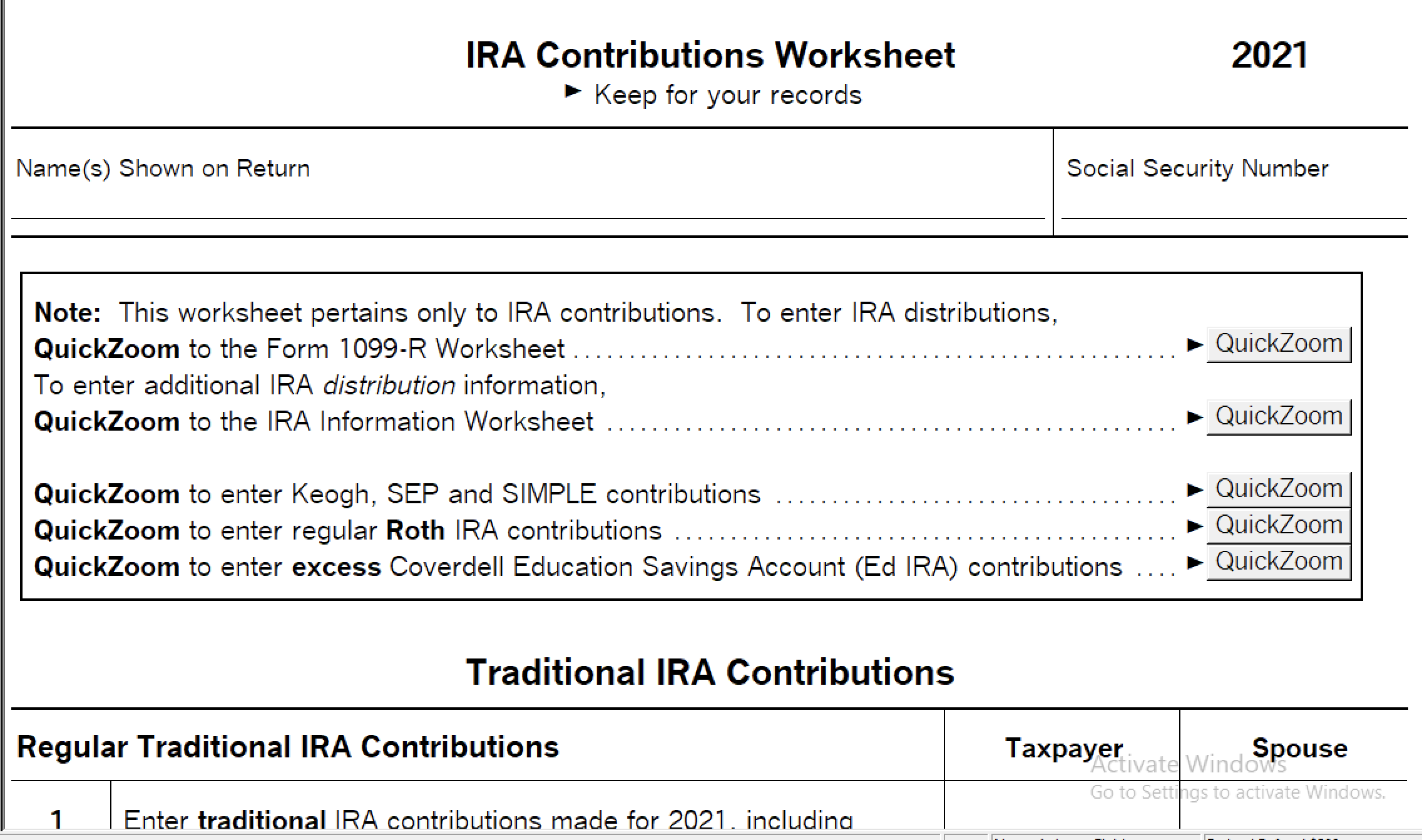

Solved: Have Non-Deductible IRA basis from 2020, converted to Roth in 2021 (backdoor Roth). How to enter this in Turbo Tax?

Solved: Have Non-Deductible IRA basis from 2020, converted to Roth in 2021 (backdoor Roth). How to enter this in Turbo Tax?

Solved: Have Non-Deductible IRA basis from 2020, converted to Roth in 2021 (backdoor Roth). How to enter this in Turbo Tax?

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

:max_bytes(150000):strip_icc()/RothIRABasis-b92eaaf7741e415aa8f934db1d5356ae.jpeg)